Policy failures may cost Nigeria historic energy windfall, expert warns

Nigeria risks forfeiting a once-in-a-generation opportunity in the global energy market due to policy missteps, regulatory frictions and inconsistent crude supply that have constrained operations at the 650,000 barrels-per-day Dangote Petroleum Refinery, a multidimensional energy expert has warned.

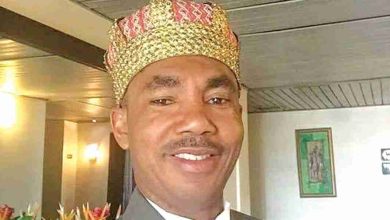

Executive Director of the Foundation for Peace Professionals (PeacePro), Abdulrazaq Hamzat, gave the warning in a statement on Friday, citing data from energy intelligence firm, Kpler, which showed that refinery shutdowns across Europe and North America have permanently eliminated between 800,000 and 900,000 barrels per day of refining capacity, thereby structurally tightening global fuel markets.

According to him, the closures have increased global dependence on late-cycle mega refineries such as the dangote facility in Nigeria and Mexico’s Dos Bocas refinery.

“This is not a refinery problem; it is a policy problem,” Hamzat said. “Nigeria has built a facility capable of shaping regional fuel markets at a time when Europe and North America are exiting refining. However, inconsistent crude supply, weak policy execution and regulatory uncertainty have prevented it from operating at full strength.”

The Dangote Refinery, he noted, has operated at only about 60-65 per cent capacity, largely due to irregular crude oil deliveries by the Nigerian National Petroleum Company Limited (NNPCL).

Although the Federal Executive Council (FEC) approved a naira-for-crude framework in 2024 to prioritise domestic refining, Hamzat said implementation has remained weak. He added that enforcement of the Domestic Crude Supply Obligation under the Petroleum Industry Act has been uneven, while the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has yet to publish verified crude supply volumes delivered to the refinery.

Hamzat also drew attention to mechanical challenges at the Residue Fluid Catalytic Cracking (RFCC) unit, which he said have been worsened by fluctuating crude quality and regulatory uncertainty around pricing, logistics and export approvals overseen by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

Kpler estimates that at full capacity, the Dangote Refinery could supply about 300,000 barrels per day of gasoline, 150,000 barrels per day of gasoil and 140,000 barrels per day of jet fuel – volumes capable of easing fuel tightness in the Atlantic Basin while significantly boosting Nigeria’s export earnings.

The ongoing corrective shutdown of the RFCC unit, Kpler noted, represents a critical inflection point, with a successful restart potentially shifting the refinery from marginal participation to structural relevance in global fuel markets by mid-2026.

To unlock the Dangote Refinery’s full potential, Hamzat outlined seven urgent steps the Federal Government must take. These include ensuring consistent crude supply through strict enforcement of the Domestic Crude Supply Obligation; establishing a federal inter-agency task force involving NNPC, NUPRC, NMDPRA and Dangote management to coordinate logistics and throughput; and providing clear regulatory guidance by fast-tracking export, pricing and product evacuation approvals.

He also called for urgent technical repairs at the RFCC unit with international support where necessary; transparent weekly performance reporting verified by independent auditors; deliberate support for exports to Atlantic Basin markets to boost foreign exchange inflows; and the removal of policy conflicts through alignment of directives across NNPC, NUPRC, NMDPRA and the Ministry of Petroleum.

“The world has shifted. If Nigeria fails to fix its internal bottlenecks, this refinery will exist without influence, and the country will remain a fuel importer in a seller’s market,” Hamzat warned.

Credit: Guardian